on this page

-

Markets

Water

-

Location

Houston, TX, USA

-

Client

Harris County Flood Control District

-

Completion date

Ongoing

Taylor Wright

VP, Principal Business Development Director, Atlanta, GA, USA contact form+1 678 247 2425

Following the devastation of Hurricane Harvey, the Texas community of Harris County was ready to rebuild and strengthen its flood control efforts. Voters approved $2.5 billion in bonds on August 25, 2018 to finance flood damage reduction projects.

Over the 10-year bond implementation time period, the Harris County Flood Control District anticipates creating or accepting more than 3,400 acres in storm water detention basins and channel improvements. Due to repetitive loss at certain properties, the District expects to continue receiving an average of nearly 40 home buyout lots per month for maintenance. Understanding that the acceptance of new infrastructure will impact the District’s funding requirements, the Harris County Commissioners Court provided a directive on September 15, 2020 for the District to “determine the increase in current maintenance and operations cost to the District budget caused by the implementation of the 2018 Flood Control Bond, year over year, for the next eight years.”

We are working with the District to develop a comprehensive Asset Management Program that will change the District’s approach to operating, maintaining and investing in its flood damage reduction infrastructure assets. The Asset Management Program will be implemented through a multistep, multi-year approach and will improve asset management practices and processes through organizational changes that will drive day-to-day O&M and capital improvement decision-based activities.

The Asset Management Program will follow best practices established through the International Organization for Standardization (ISO) 55000 series of standards for asset management. A primary component of these best practices is performance-driven budgeting, where the budget process begins with an evaluation of the current condition of assets and how they deteriorate over time. This condition-based approach is anticipated to utilize inspection data and engineering expert input on how assets deteriorate over the design life to drive short- and long-term planning and budgeting requirements. The approach will consider the timing of investments and the effect that timing will have on the value that the investment delivers in risk mitigation, financial and non-financial benefits and cost. This enables the creation of a risk-informed, evidence-based investment plan that delivers the highest value to the community. The performance-driven approach to developing maintenance budgets and forward-looking financial plans also directly enables a cause-effect capability. What-if analysis can be conducted on the condition, function and overall performance of the assets, with forecasting tailored to different budget scenarios.

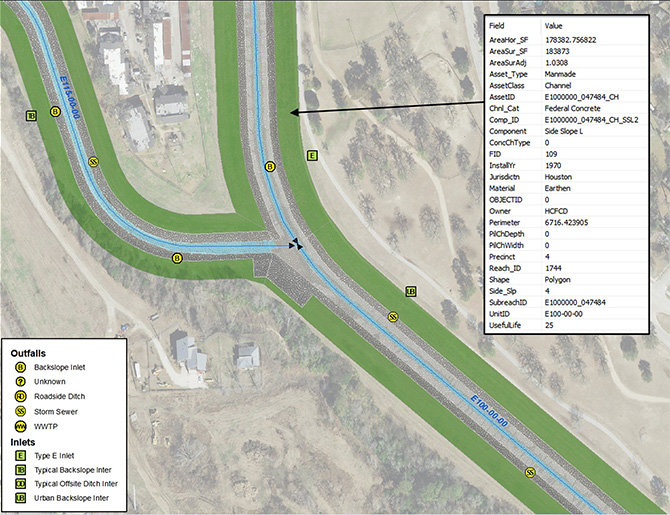

In the initial phase of the project we worked with the District to develop interim policies and strategies and initiate cross-organizational buy-in. We developed an asset hierarchy and inventory for 140-miles of concrete-lined channels and associated assets. Previously the District’s assets were not centrally and comprehensively inventoried. As a cornerstone of the Asset Management Program, we also developed an asset management risk framework. The framework is based on five risk criteria for promoting an equitable application of maintenance funding: social vulnerability, historic structural flooding, channel capacity, development age and development intensity. These five criteria are used to measure risk and to apply a total risk score to each asset, ensuring that District assets with a higher risk will receive priority in repair or replacement.

Another cornerstone of the Asset Management Program initial phase is lifecycle cost modeling for District assets. We used lifecycle cost modeling to assess approximately $1.1 billion in District assets over a 100-year period with funding scenarios that included major maintenance, vegetation management and end of life renewal. Four different funding scenarios were simulated to demonstrate funding requirements needed to achieve various average long-term performance conditions of the channel assets in the model. The interim modeling results highlight the relationship of funding levels and the long-term condition of the District’s asset portfolio. In future phases of the Asset Management Program, the O&M budget levels are anticipated to be routinely evaluated, optimizing available funding for future plan enactment.

Looking ahead to future phases of the project, we will deploy a Strategic Asset Management Plan. The plan will develop long-term maintenance and capital renewal estimates for all District assets in the Asset Management Program. In addition to further development of the asset inventory and hierarchy assessed in Phase I, we will field test inspection methods leading up to data collection activities for District-wide assets.

The Asset Management Program will shift the District’s approach of estimating future maintenance costs based on past expenditures to a forward-looking strategy based on up-to-date District asset data. The approach will allow the District to optimize application of available O&M and capital improvement funding to achieve the best long-term condition and function of District assets. The program will also provide a method to routinely evaluate various budget levels and their resulting future effects on the District’s asset portfolio. The results of the program will allow decision-makers to plan future O&M and capital improvement budgets based on desired asset condition, asset function and available funding, creating a dependable and sustainable flood damage reduction infrastructure plan for Harris County residents.

AtkinsRéalis developed an asset inventory for approximately 140-miles of channels and associated assets.

Please note that you are now leaving the AtkinsRéalis website (legal name: AtkinsRéalis Group inc.) and entering a website maintained by a third party (the "External Website") and that you do so at your own risk.

AtkinsRéalis has no control over the External Website, any data or other content contained therein or any additional linked websites. The link to the External Website is provided for convenience purposes only. By clicking "Accept" you acknowledge and agree that AtkinsRéalis is not responsible, and does not accept or assume any responsibility or liability whatsoever for the data protection policy, the content, the data or the technical operation of the External Website and/or any linked websites and that AtkinsRéalis is not liable for the terms and conditions (or terms of use) of the External Website. Further, you acknowledge and agree that you assume all risks resulting from entering and/or using the External Website and/or any linked websites.

BY ENTERING THE EXTERNAL WEBSITE, YOU ALSO ACKNOWLEDGE AND AGREE THAT YOU COMPLETELY AND IRREVOCABLY WAIVE ANY AND ALL RIGHTS AND CLAIMS AGAINST ATKINSRÉALIS, AND RELEASE, DISCHARGE, INDEMNIFY AND HOLD HARMLESS ATKINSRÉALIS, ITS OFFICERS, EMPLOYEES, DIRECTORS AND AGENTS FROM ANY AND ALL LIABILITY INCLUDING BUT NOT LIMITED TO LIABILITY FOR LOSS, DAMAGES, EXPENSES AND COSTS ARISING OUT OF OR IN CONNECTION WITH ENTERING AND/OR USING THE EXTERNAL WEBSITE AND/OR ANY LINKED WEBSITES AND ANY DATA AND/OR CONTENT CONTAINED THEREIN.

Such waiver and release specifically includes, without limitation, any and all rights and claims pertaining to reliance on the data or content of the External Website, or claims pertaining to the processing of personal data, including but not limited to any rights under any applicable data protection statute. You also recognize by clicking “Accept” that the terms of this disclaimer are reasonable.

The information provided by Virtua Research cited herein is provided “as is” and “as available” without warranty of any kind. Use of any Virtua Research data is at a user’s own risk and Virtua Research disclaims any liability for use of the Virtua Research data. Although the information is obtained or compiled from reliable sources Virtua Research neither can nor does guarantee or make any representation or warranty, either express or implied, as to the accuracy, validity, sequence, timeliness, completeness or continued availability of any information or data, including third-party content, made available herein. In no event shall Virtua Research be liable for any decision made or action or inaction taken in reliance on any information or data, including third-party content. Virtua Research further explicitly disclaims, to the fullest extent permitted by applicable law, any warranty of any kind, whether express or implied, including warranties of merchantability, fitness for a particular purpose and non-infringement.

The consensus estimate provided by Virtua Research is based on estimates, forecasts and predictions made by third party financial analysts, as described above. It is not prepared based on information provided by AtkinsRéalis and can only be seen as a consensus view on AtkinsRéalis' possible future results from an outside perspective. AtkinsRéalis has not provided input on these forecasts, except by referring to past publicly disclosed information. AtkinsRéalis does not accept any responsibility for the quality or accuracy of any individual or average of forecasts or estimates. This web page contains forward-looking statements based on current assumptions and forecasts made by third parties. Various known and unknown risks, uncertainties and other factors could lead to material differences between AtkinsRéalis' actual future results, financial situation, development or performance, and the estimates given here.

Downloads

Trade releases