-

Markets

Transportation

Roger Cruickshank

Senior Director, Dubai, UAE contact form+971 4 405 9300

During the United Nations Climate Change Conference (COP27), the transport sector reiterated its commitment to reducing carbon emissions to net-zero by 2050, in line with the Paris Agreement. Achieving this will depend on efficient multi-modal transport systems and associated services that are essential to ensure sustainable mobility of people and goods.

GCC countries, in particular Saudi Arabia, UAE, and Qatar have invested heavily in their transport networks in the past decade, but there can be no denying that for internal travel all countries are still heavily reliant on fossil fuel-based car ownership and use, as well as road-based freight. Among other reasons, this is due to the rapid growth of cities and communities that have been designed around the car.

To help the region achieve its Net Zero targets, AtkinsRéalis has published the “Engineering Net Zero in the GCC” report that highlights challenges, opportunities, and recommendations to decarbonize the built environment, energy, and transport sectors.

Public transport

Dubai’s metro opened in 2009, Doha’s in 2019 and Riyadh’s will begin operating shortly. In addition, buses have seen improvements in scale and quality in recent years and may become more important for short distance journeys, supported by walking, cycling and micromobility. In terms of rail, Saudi Arabia has the most extensive rail network in the GCC, offering freight and passenger services across three lines. The longest at 2,800km is the Northern Train Network, running from Riyadh to Jordan. Within the UAE, the Etihad Rail element of the GCC network will stretch across 1,200km and run to the borders of Saudi Arabia and Oman. Once construction has been completed, the GCC Rail Network will connect major cities across all six GCC countries and taking a large number of heavy goods vehicles off the roads.

More public transport is needed to meet decarbonization plans within the various Net Zero national strategies. Significant investment is required to extend current lines, routes and interconnections that allow for longer journeys and residential communities need to be better served if car use and ownership is to be reduced. First and last mile connectivity must also be improved to make it easier to access the public transport network. Plans for national passenger and freight rail need to be extended, whether conventional, high-speed or new technologies such as Hyperloop or Maglev; as long as they are electrified, and that power comes from clean energy sources.

Electric and hydrogen vehicles

Many GCC communities have been developed or expanded around road infrastructure. Getting people to shift en masse to public transport would be a significant task that is unlikely to be appropriate within the region, at least in the short term. If people will not abandon their cars, then the region needs a policy of electrification, be that Battery Electric Vehicles (BEVs) or hydrogen Fuel Cell Electric Vehicles (FCEVs).

Electric Vehicles (EVs) use is increasing. In May 2021, 3,100 EVs and 9,300 hybrid cars were registered in Dubai alone and the UAE wants 42,000 EVs on its roads by 2030. Dubai’s commitment to electric cars has gained momentum through the recent opening of a EV manufacturing facility in Dubai Industrial City with manufacturing capacity of 10,000 cars annually and the government agencies having converted 20% of automobile fleet to EVs. 3% of car sales in Saudi Arabia were for hybrid and EVs in 2020, and the government has stated that by 2030, 30% of cars in Riyadh will be electric.

However, adoption of EVs alone will not decarbonize the region’s transport infrastructure. They take the same space as petrol and diesel cars and must be able to cope with the region’s high summer temperatures when car users are reliant on battery-draining air conditioning to cool their vehicles. To meaningfully decarbonize transport, charging points must be expanded and powered by renewable energy sources. This again, proves the critical link between energy and transportation.

Aviation

Around the Gulf, airports are being built, expanded or upgraded to attract more passengers or freight business. Dubai remains the busiest international airport in the world, having successfully built a world-leading aviation hub and air fleet in the past decade. In 2019, it had more than 85 million passengers through the airport and handled around 2.5 million tonnes of freight. These major aviation hubs add pressure to government Net Zero strategies, as aviation levels return to pre-pandemic levels. For instance, Dubai’s 2021 passenger numbers were 29 million, although freight was in line with previous years, at 2.3 million tonnes. For 2022, Dubai estimates it will have 55 million people travel through its airport.

Due to the complexity of the aviation sector, it will likely decarbonize later than other transport modes. Regulatory and policy frameworks at global and regional levels need to be established to drive the development of sustainable aviation fuels (including hydrogen), and this will require collaboration across the whole sector. Key to minimizing the carbon footprint for airports is to focus firstly on greater energy efficiency within buildings, followed by usage of low carbon/net zero energy. Through smart building technologies, airport operators can manage demand and optimize technical infrastructure to drive savings in energy usage. Decarbonizing airport vehicle fleets, as well as making staff commuting and passenger access trips more sustainable, are other areas to be tackled.

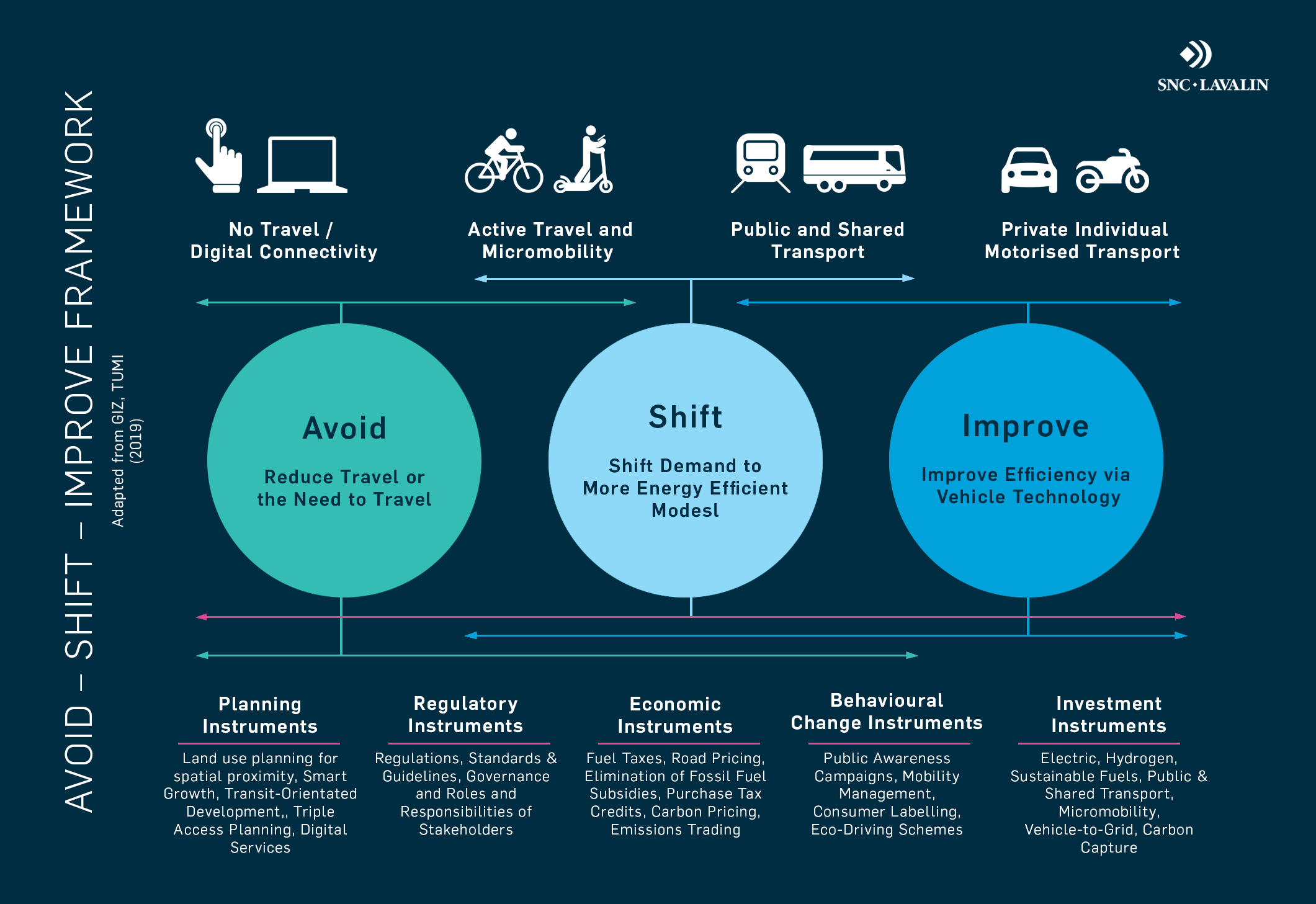

In conclusion, changing long-held behavior towards land-based mobility will be challenging, and require a combination of awareness and policies. An appropriate future approach that can be taken is that of Avoid, Shift and Improve which offers a useful way forward for key public agencies and private sector stakeholders to integrate planning and action across the value chain. The first two options focus on behavioral change – getting people to think differently about how they travel or access transport services. A broader perspective is required that ensures the long-term planning of a functional, integrated transport strategy, including balancing supply-based approaches with the management of demand, as well as user attitudes and behavior.

This article was first published in ME Construction News in November 2022.

Please note that you are now leaving the AtkinsRéalis website (legal name: AtkinsRéalis Group inc.) and entering a website maintained by a third party (the "External Website") and that you do so at your own risk.

AtkinsRéalis has no control over the External Website, any data or other content contained therein or any additional linked websites. The link to the External Website is provided for convenience purposes only. By clicking "Accept" you acknowledge and agree that AtkinsRéalis is not responsible, and does not accept or assume any responsibility or liability whatsoever for the data protection policy, the content, the data or the technical operation of the External Website and/or any linked websites and that AtkinsRéalis is not liable for the terms and conditions (or terms of use) of the External Website. Further, you acknowledge and agree that you assume all risks resulting from entering and/or using the External Website and/or any linked websites.

BY ENTERING THE EXTERNAL WEBSITE, YOU ALSO ACKNOWLEDGE AND AGREE THAT YOU COMPLETELY AND IRREVOCABLY WAIVE ANY AND ALL RIGHTS AND CLAIMS AGAINST ATKINSRÉALIS, AND RELEASE, DISCHARGE, INDEMNIFY AND HOLD HARMLESS ATKINSRÉALIS, ITS OFFICERS, EMPLOYEES, DIRECTORS AND AGENTS FROM ANY AND ALL LIABILITY INCLUDING BUT NOT LIMITED TO LIABILITY FOR LOSS, DAMAGES, EXPENSES AND COSTS ARISING OUT OF OR IN CONNECTION WITH ENTERING AND/OR USING THE EXTERNAL WEBSITE AND/OR ANY LINKED WEBSITES AND ANY DATA AND/OR CONTENT CONTAINED THEREIN.

Such waiver and release specifically includes, without limitation, any and all rights and claims pertaining to reliance on the data or content of the External Website, or claims pertaining to the processing of personal data, including but not limited to any rights under any applicable data protection statute. You also recognize by clicking “Accept” that the terms of this disclaimer are reasonable.

The information provided by Virtua Research cited herein is provided “as is” and “as available” without warranty of any kind. Use of any Virtua Research data is at a user’s own risk and Virtua Research disclaims any liability for use of the Virtua Research data. Although the information is obtained or compiled from reliable sources Virtua Research neither can nor does guarantee or make any representation or warranty, either express or implied, as to the accuracy, validity, sequence, timeliness, completeness or continued availability of any information or data, including third-party content, made available herein. In no event shall Virtua Research be liable for any decision made or action or inaction taken in reliance on any information or data, including third-party content. Virtua Research further explicitly disclaims, to the fullest extent permitted by applicable law, any warranty of any kind, whether express or implied, including warranties of merchantability, fitness for a particular purpose and non-infringement.

The consensus estimate provided by Virtua Research is based on estimates, forecasts and predictions made by third party financial analysts, as described above. It is not prepared based on information provided by AtkinsRéalis and can only be seen as a consensus view on AtkinsRéalis' possible future results from an outside perspective. AtkinsRéalis has not provided input on these forecasts, except by referring to past publicly disclosed information. AtkinsRéalis does not accept any responsibility for the quality or accuracy of any individual or average of forecasts or estimates. This web page contains forward-looking statements based on current assumptions and forecasts made by third parties. Various known and unknown risks, uncertainties and other factors could lead to material differences between AtkinsRéalis' actual future results, financial situation, development or performance, and the estimates given here.

Downloads

Trade releases