on this page

The AtkinsRéalis 2024 Mid-Year Construction Data Intelligence® Report highlights key information collected from January to June 2024 on the construction market and wider economy. This data is used in both internal and external deliverables to inform colleagues and clients about the current state of the construction industry. For those interested in staying up to date with the latest market data, this information provides valuable insights into how to account for external economic factors when planning projects.

Bid Price

National nonresidential building bid prices remain stable

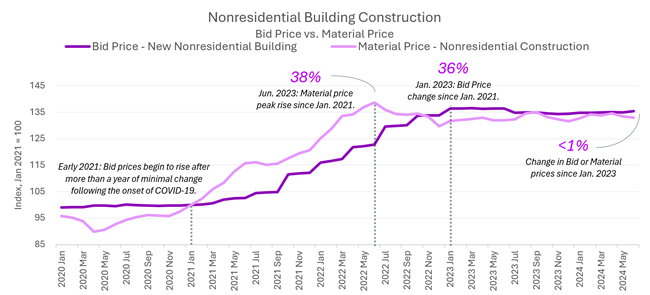

National bid prices for nonresidential building construction have remained nearly flat since January 2023. In fact, the national price level decreased by 0.67% between January 2023 and June 2024. This recent period of stability follows a time of historically rapid escalation beginning in mid-2021 and lasting through 2022. Bid price escalation over the last six months is approximately 0.8%.

Recent escalation remains below the historical norm

The recent change in the national bid price level is low compared to the normal historical level pre-2020, but the latest six-month rise is greater than the total change over the last twelve months. Notably, the increase measured in the latest monthly change between May and June of 0.37% is the largest monthly change measured in more than a year.

By historical standards, it is very unusual for bid prices to remain flat for an extended period. For context, the total escalation from January 2015 to January 2020 was just shy of 16%, or about 3% per year. This is a reasonable benchmark for typical annual escalation during a period of relative economic stability without significant market impacts from major external events. By contrast, the national bid price escalation from January 2021 to January 2023 was about 36% or approximately 17% per year.

The period of zero escalation can’t last forever

The national bid price movement has been unusual for a few years, and it hasn't proven easy to predict. The initial impact of COVID-19 on bid prices in 2020 was a relatively short-lived period of stagnation. Beginning in early 2021 prices skyrocketed reaching a recent peak about two years later in early 2023. Since this peak, the national bid price level dropped slightly and has slowly risen in recent months.

There are signs of reduced activity from contractors and architects which may indicate lower price pressures, but the increases in activity in the manufacturing and industrial sectors will probably push up costs. The most recent data show escalation is picking up slightly, but the long-term trajectory is unclear. However, it is prudent to carry an escalation contingency assuming there will be future escalation close to pre-COVID-19 levels of around 3% per year.

Material Price

Average construction material prices continue a long period of minimal change, but there are outliers

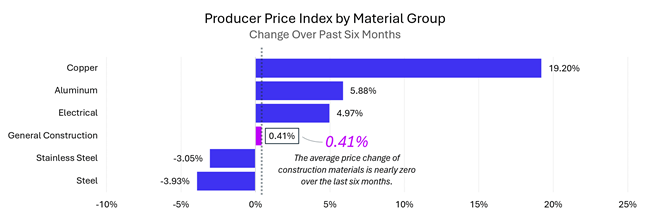

Similar to the national bid price level, the average price level for materials related to the construction industry has shown minimal variation in recent history. Over the last six months, construction material prices have only increased by 0.41%. The same series over the last year reports a decrease of more than two percent.

Despite little average change, prices for certain material groups have been quite volatile. Copper, aluminum and electrical groups have reported the most change of 19.20%, 5.88% and 4.97% over the last six months, respectively. On the other end of the spectrum, steel and stainless steel have reported price reductions over the same period.

Metals pricing remains volatile while average construction materials appear relatively stable

Average construction material prices slowly trended downward from mid-2022 to late-2023, falling as much as 8% during that time. Monthly variations were mostly minimal during this period, a trend that has continued.

Prices for many metals have fluctuated more rapidly, with aluminum and steel products showing relatively large variability over the last few years. Peak copper prices from 2021 through 2023 did not rise as sharply as those for aluminum and steel. However, copper prices have exploded in the first half of 2024, much more rapidly than the other metals presented. Electrical component price escalation has been much steadier with consistent month-to-month increases since late 2021. This steady upward trend appears to persist through the latest data.

Uncertainty at a higher price floor

While average construction material prices have changed very little over the last year, the overall price floor is much higher now than it was pre-pandemic. The average construction material price level now is nearly 30% higher than it was in January 2021, equivalent to an average annual rate of more than 7%, surpassing a more typical historical annual rate. Furthermore, some material groups have deviated from the mean by a significant degree.

Looking forward

Project owners need to be aware of the price changes of major cost drivers, and how price increases for raw and intermediate materials can impact the price of final fabricated goods. For example, higher copper prices could implicate the price changes observed in electrical components. It is essential to maintain regular communication with suppliers and consider how major investments and initiatives may impact resource demand and, therefore, prices for high-demand materials.

Construction Value

Manufacturing spending continues strong growth, along with increases in institutional sectors

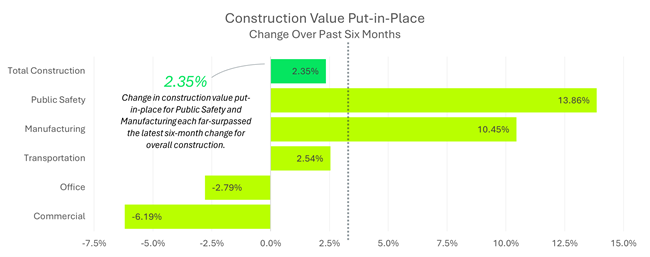

Over the past six months, monthly construction investment has grown substantially for the institutional, infrastructure and manufacturing sectors. Commercial investment fell by a substantial margin during the same period, continuing a prolonged period of softening.

Federal spending spurs on major project investments

Manufacturing spending exploded in recent years, largely due to strong interest and potential financial support from federal government programs such as the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act and Inflation Reduction Act. Additionally, sectors related to government, institutional and infrastructure projects have shown increased spending. Many of these projects could be recipients of federal investments from the Infrastructure Investment and Jobs Act (IIJA).

Huge federal programs are key to the increased spending observed in the sectors showing the greatest levels of growth. These programs are largely aimed at strengthening major industries and improving public resources in the United States. As long as strong interest and federal support for these programs persist, major investments in industrial and civil projects will continue.

At the same time, the national commercial construction market has remained cool, and monthly construction investment has steadily declined more than 12% since September 2023. This is a major reversal compared to recent years when total monthly commercial value grew by 70% between the summer of 2020 and the end of 2022.

Understanding market limitations

Massive investments in infrastructure, manufacturing, clean energy and other sectors have contributed to an enormous expansion of construction spending over the last few years. Many new large-scale projects in these sectors are drawing substantial volumes of resources including materials, equipment and skilled labor, increasing competition and limiting availability. Prices for in-demand resources have surged, and lead times for some items have extended.

Project owners need to be aware of the main resource constraints their contractors and suppliers are facing to identify problems and work to find solutions. Early engagement and open communication with partners can help alleviate potential issues on projects.

Market Indicators

National slowdown in architecture billings

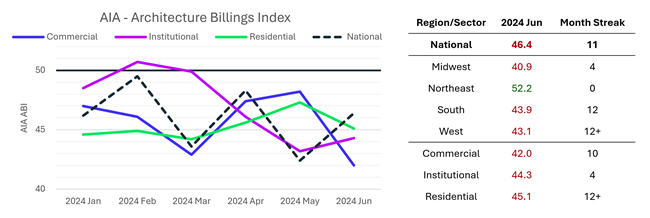

The national Architecture Billings Index (ABI) from the American Institute of Architects (AIA) has shown continuous monthly declines for the past year. This suggests a slowdown in construction starts could be likely in the near term, based on the AIA’s explanation that architecture billings lead construction starts by about nine to twelve months.

All sectors have reported decreases in architecture billings for at least four consecutive months. Residential firms report the longest streak of decreases of any sector with more than a year of uninterrupted monthly declines. The Northeast is the first region to report an increase in billings since the first quarter of this year. All other regions continue to show monthly declines, and the South and West regions have now each reported declines of at least one year.

Correction after the post-pandemic boom

Most regions and sectors reported billings growth throughout most of 2021 and 2022, followed by little change in the first half of 2023. However, since August 2023 national architecture billings have continuously fallen each month, reaching a recent low of 42.4 in May. The last time the national index fell to this level was in 2020 during the pandemic.

It is important to put this in perspective. Despite recent lows, these values come on the heels of record high levels reached in 2021 and 2022 achieved during the pandemic recovery. It is natural to expect work would slow down at some point after reaching these heights. The potential issue lies in a prolonged period of declining activity. If decreases persist, it could point to a softening market.

A quieter market could be good for prospective project owners if there is less competition for resources, as long as a slowdown does not point to a larger issue within the industry or greater economy. For example, stubbornly high interest rates could restrict future construction growth if projects can't secure financing from reluctant investors.

Notes and Disclaimers

- Source data has been filtered by AtkinsRéalis to highlight key information and particular points of interest.

- Some indexed values have been rebased to dates different than provided by the source.

Sources

- Bid Price

- U.S. Bureau of Labor Statistics, Producer Price Index

- Material Price

- U.S. Bureau of Labor Statistics, Producer Price Index

- Construction Value

- U.S. Census Bureau, Construction Spending

- Market Indicators

- American Institute of Architects, AIA/Deltek Architecture Billings Index

Please note that you are now leaving the AtkinsRéalis website (legal name: AtkinsRéalis Group inc.) and entering a website maintained by a third party (the "External Website") and that you do so at your own risk.

AtkinsRéalis has no control over the External Website, any data or other content contained therein or any additional linked websites. The link to the External Website is provided for convenience purposes only. By clicking "Accept" you acknowledge and agree that AtkinsRéalis is not responsible, and does not accept or assume any responsibility or liability whatsoever for the data protection policy, the content, the data or the technical operation of the External Website and/or any linked websites and that AtkinsRéalis is not liable for the terms and conditions (or terms of use) of the External Website. Further, you acknowledge and agree that you assume all risks resulting from entering and/or using the External Website and/or any linked websites.

BY ENTERING THE EXTERNAL WEBSITE, YOU ALSO ACKNOWLEDGE AND AGREE THAT YOU COMPLETELY AND IRREVOCABLY WAIVE ANY AND ALL RIGHTS AND CLAIMS AGAINST ATKINSRÉALIS, AND RELEASE, DISCHARGE, INDEMNIFY AND HOLD HARMLESS ATKINSRÉALIS, ITS OFFICERS, EMPLOYEES, DIRECTORS AND AGENTS FROM ANY AND ALL LIABILITY INCLUDING BUT NOT LIMITED TO LIABILITY FOR LOSS, DAMAGES, EXPENSES AND COSTS ARISING OUT OF OR IN CONNECTION WITH ENTERING AND/OR USING THE EXTERNAL WEBSITE AND/OR ANY LINKED WEBSITES AND ANY DATA AND/OR CONTENT CONTAINED THEREIN.

Such waiver and release specifically includes, without limitation, any and all rights and claims pertaining to reliance on the data or content of the External Website, or claims pertaining to the processing of personal data, including but not limited to any rights under any applicable data protection statute. You also recognize by clicking “Accept” that the terms of this disclaimer are reasonable.

The information provided by Virtua Research cited herein is provided “as is” and “as available” without warranty of any kind. Use of any Virtua Research data is at a user’s own risk and Virtua Research disclaims any liability for use of the Virtua Research data. Although the information is obtained or compiled from reliable sources Virtua Research neither can nor does guarantee or make any representation or warranty, either express or implied, as to the accuracy, validity, sequence, timeliness, completeness or continued availability of any information or data, including third-party content, made available herein. In no event shall Virtua Research be liable for any decision made or action or inaction taken in reliance on any information or data, including third-party content. Virtua Research further explicitly disclaims, to the fullest extent permitted by applicable law, any warranty of any kind, whether express or implied, including warranties of merchantability, fitness for a particular purpose and non-infringement.

The consensus estimate provided by Virtua Research is based on estimates, forecasts and predictions made by third party financial analysts, as described above. It is not prepared based on information provided by AtkinsRéalis and can only be seen as a consensus view on AtkinsRéalis' possible future results from an outside perspective. AtkinsRéalis has not provided input on these forecasts, except by referring to past publicly disclosed information. AtkinsRéalis does not accept any responsibility for the quality or accuracy of any individual or average of forecasts or estimates. This web page contains forward-looking statements based on current assumptions and forecasts made by third parties. Various known and unknown risks, uncertainties and other factors could lead to material differences between AtkinsRéalis' actual future results, financial situation, development or performance, and the estimates given here.

Downloads

Trade releases