on this page

5 Critical Questions We Must Ask to Align the Project Delivery Ecosystem towards Sustainable Outcomes for the Built Environment.

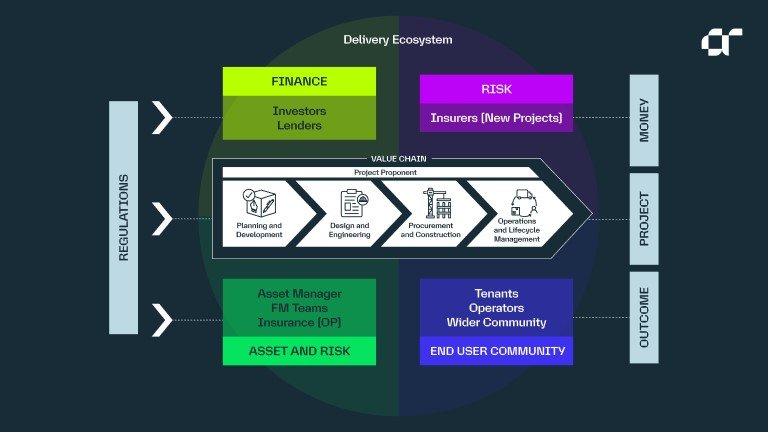

Some of this investment is straightforward – we need a rapid expansion in technologies that drive the low carbon energy transition. But for the built and natural environment, systems thinking is crucial for developing solutions capable of addressing these multifaceted challenges. However, across the investment and delivery spheres of the wider delivery ecosystem, adoption of systems thinking is misaligned. Investors and delivery teams are driven by different metrics, often overlooking each other's operational realities, which can obscure key financial and climate underperformance.

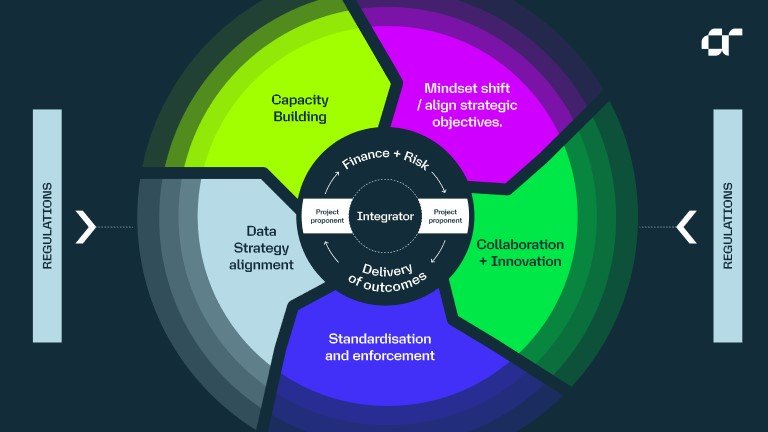

Here are 5 critical questions that highlight key areas where we can come together, stay together, and work together to overcome silos and drive success for sustainable outcomes.

An investor’s or project proponent’s mindset influences every aspect of a project. And this mindset can be either short or long term. Existing financial instruments like PPPs, project loans, and Blended Finance often focus on short-term CAPEX rather than long-term sustainability, disconnecting upfront investment from long-term operational goals. Moreover, the project delivery sphere, heavily influenced by CAPEX, programme, quality, and safety pressures, rarely prioritizes OPEX, TOTEX or whole-life performance unless contractually required. This can be further compounded by the ownership models (i.e. owner/operator vs lease/manager) of the assets / investments which often dictate short- or long-term thinking.

Of course, there are always exceptions, where companies have a more mature approach to asset management. More mature approaches are often the consequence of operating in regulated markets such as water or energy or down to the underlying ownership model (e.g. owner / operators vs lease/management). Nonetheless, ESG metrics often miss specific operational realities or the granular detail that influence key decisions through design, construction, and operation.

As climate events start to impact assets within a single investment cycle, this should start to affect the Weighted Average Cost of Capital (WACC). Consequently, the standards we use to measure ESG and resilience need to speak directly to risk— both physical and transitional (including stranding risks) —if they are to be effective tools aligned with real-world investment decisions. Understanding the different risk profiles and drivers behind greenfield and brownfield investments is crucial for investors when making decisions. Greenfield investments typically involve higher risks due to the development of new infrastructure, while brownfield investments may have lower risks as they involve upgrading or expanding existing infrastructure. There is a significant role here for the insurance sector too help manage these risks more intelligently, but this needs to be developed.

Developing consistent sustainability metrics and embedding them in outcome-based contracts is crucial. Standards like BREEAM, LEED, and Envision provide excellent frameworks but are regionally nuanced and front-loaded, lacking post-build performance guarantees. These standards help frame delivery but need to be paired with better-structured contracts capable of addressing real-world delivery challenges. Enterprise models like the UK’s Project 13 as well as alliance models drive deeper collaboration.

Integrating these models early fosters value and supply chain collaboration which enables innovation at impactful stages. These experiences have been a key inspiration behind AtkinsRéalis’ Decarbonomics™ platform, which promotes holistic value through total portfolio management, focusing on whole-life cost, carbon, and resilience performance, tracking metrics for diverse stakeholders across the entire delivery ecosystem.

Prioritizing long term value outcomes is crucial. There are promising signs that this is happening. Some large global institutional investors such as pension funds are now promoting ‘active ownership’ finance models where proactive stewardship of their investments is increasingly the norm driven by the fiduciary duty. This shift fosters deeper collaboration and enhances the influence of investment teams to challenge project proponents and operational teams on their procurement and management of projects, ensuring they account for the total cost of ownership or other whole life considerations.

Embedding quantifiable metrics early ensures alignment. The adage ‘what gets measured gets managed’ is key. Metrics must incentivize the entire value and supply chain and provide investor clarity and confidence, especially for outcomes like resilience, biodiversity, and social value. Investments and projects that tend to successfully connect these metrics with long term mindsets stand to deliver the greatest value and returns.

While collaboration is common, it’s not systematic - especially between the investment and delivery communities at scale. Frameworks like BREEAM, Envision, and PAS2080 help operationalize system thinking, and models like Enterprise Models and Alliancing are emerging, especially for large-scale greenfield projects. However, more systematic collaboration between investors and project proponents, along with their project delivery teams, is crucial. Initiatives like 3Ci in the UK and the Green Bank Network in the US, which enable better project origination with well packaged bundles of investable, de-risked sustainable projects, should become more prominent, especially for cash constrained local authorities and cities.

Failure to integrate investment insights with project realities risks losing valuable perspectives - we need to left- and right-shift knowledge across the whole delivery ecosystem. Knowledge must be shared from the start and throughout the investment lifecycle. Financing models should engage the entire supply chain during planning and design to align on long-term sustainability goals, helping to structure collaborative and performance or outcome based contracting vehicles. This could include mandating sustainability certifications and performance targets linked to the investors objectives. There is also the option to expand models such as P13, or Integrated Project Delivery (IPD) to PPPs and green bond-funded projects.

Lead author: Stuart McLaren, contributor: Francis Heil.

Please note that you are now leaving the AtkinsRéalis website (legal name: AtkinsRéalis Group inc.) and entering a website maintained by a third party (the "External Website") and that you do so at your own risk.

AtkinsRéalis has no control over the External Website, any data or other content contained therein or any additional linked websites. The link to the External Website is provided for convenience purposes only. By clicking "Accept" you acknowledge and agree that AtkinsRéalis is not responsible, and does not accept or assume any responsibility or liability whatsoever for the data protection policy, the content, the data or the technical operation of the External Website and/or any linked websites and that AtkinsRéalis is not liable for the terms and conditions (or terms of use) of the External Website. Further, you acknowledge and agree that you assume all risks resulting from entering and/or using the External Website and/or any linked websites.

BY ENTERING THE EXTERNAL WEBSITE, YOU ALSO ACKNOWLEDGE AND AGREE THAT YOU COMPLETELY AND IRREVOCABLY WAIVE ANY AND ALL RIGHTS AND CLAIMS AGAINST ATKINSRÉALIS, AND RELEASE, DISCHARGE, INDEMNIFY AND HOLD HARMLESS ATKINSRÉALIS, ITS OFFICERS, EMPLOYEES, DIRECTORS AND AGENTS FROM ANY AND ALL LIABILITY INCLUDING BUT NOT LIMITED TO LIABILITY FOR LOSS, DAMAGES, EXPENSES AND COSTS ARISING OUT OF OR IN CONNECTION WITH ENTERING AND/OR USING THE EXTERNAL WEBSITE AND/OR ANY LINKED WEBSITES AND ANY DATA AND/OR CONTENT CONTAINED THEREIN.

Such waiver and release specifically includes, without limitation, any and all rights and claims pertaining to reliance on the data or content of the External Website, or claims pertaining to the processing of personal data, including but not limited to any rights under any applicable data protection statute. You also recognize by clicking “Accept” that the terms of this disclaimer are reasonable.

The information provided by Virtua Research cited herein is provided “as is” and “as available” without warranty of any kind. Use of any Virtua Research data is at a user’s own risk and Virtua Research disclaims any liability for use of the Virtua Research data. Although the information is obtained or compiled from reliable sources Virtua Research neither can nor does guarantee or make any representation or warranty, either express or implied, as to the accuracy, validity, sequence, timeliness, completeness or continued availability of any information or data, including third-party content, made available herein. In no event shall Virtua Research be liable for any decision made or action or inaction taken in reliance on any information or data, including third-party content. Virtua Research further explicitly disclaims, to the fullest extent permitted by applicable law, any warranty of any kind, whether express or implied, including warranties of merchantability, fitness for a particular purpose and non-infringement.

The consensus estimate provided by Virtua Research is based on estimates, forecasts and predictions made by third party financial analysts, as described above. It is not prepared based on information provided by AtkinsRéalis and can only be seen as a consensus view on AtkinsRéalis' possible future results from an outside perspective. AtkinsRéalis has not provided input on these forecasts, except by referring to past publicly disclosed information. AtkinsRéalis does not accept any responsibility for the quality or accuracy of any individual or average of forecasts or estimates. This web page contains forward-looking statements based on current assumptions and forecasts made by third parties. Various known and unknown risks, uncertainties and other factors could lead to material differences between AtkinsRéalis' actual future results, financial situation, development or performance, and the estimates given here.

Downloads

Trade releases